Contents:

Accounting profit differs from other types of profits such as cash profit, economic profit, and taxable profit. ABC Co. must first calculate its total explicit expenses to calculate its accounting profit. The explicit expenses of ABC Co. will consist of all the above expenses, as they are identifiable and measurable already. Thirdly, accounting profit is critical in securing loans from financial institutions. First of all, if a business keeps making accounting profits but fails to generate a cash profit, it will not be able to meet its cash payment obligations on time. As the company used its equipment, the machinery dropped in value by $2,000 due to wear and tear.

Gross Profit vs. Net Income: What’s the Difference? – Investopedia

Gross Profit vs. Net Income: What’s the Difference?.

Posted: Sat, 25 Mar 2017 17:53:43 GMT [source]

This reduction in value is then taken into consideration as depreciation when calculating accounting profit for the corn processing company. The gross profit of a business is also known as its gross income. Gross profit is defined as a business’s profits after subtracting the cost of goods sold from the company’s total revenue. You can find Gross Profit on a company’s income statement, and it’s calculated by subtracting the cost of goods sold from the company’s total sales revenue.

What Is Revenue? Definition and Formula

Taxable profit is the value used for tax declaration after adjusting accounting profit. To calculate the value, the company needs to alter accounting profits that are allowed under accounting standards and tax law. Like with accounting profit, you can also find totals by looking at your income statement.

Net Income measures the after-tax earnings of a company that remain once all expenses are deducted, most often reported on either a quarterly or annual basis. The accounting standards allow company managers some discretion in determining the size and timing of expense recognition in certain cases. This can result in significant swings in the amount of profit reported. Included in the firm’s stock account at the beginning of the year are seven cameras that cost £100 each.

What is Net Profit Margin? Formula for Calculation and Examples – Investopedia

What is Net Profit Margin? Formula for Calculation and Examples.

Posted: Tue, 28 Mar 2017 08:23:18 GMT [source]

Additionally, say if you’ve calculated income for a friend or family member’s small business. When equilibrium is achieved for economic profit, the business’s implicit costs equal explicit costs, and debt holders and equity holders receive their required rate of return. Accounting profit is the amount of money left over after subtracting the business’s explicit costs. Explicit costs are simply the precise quantities paid by a corporation for certain expenditures during that period, such as wages.

Types of Profit: Definition of Normal Profit

Economic profit encompasses actions not taken or options foregone. Therefore, it provides a larger, more comprehensive portrayal of a company’s situation. If a business has a low gross profit, its focus should be on reducing the cost to fulfill sales. It’s important to not only know how much money a business is keeping after all expenses, but also each level of profitability. Gross profit subtracts only the direct cost of producing goods from the total revenue.

You can use accounting profit to look at your business’s financial performance and see how profitable your business is. Economic profit is important because it measures the costs of taking one business action over an alternative, something that accounting profit does not count. These are expenses such as employee wages, utility bills, etc., that do not directly help produce goods and services. There are many different types of profits in accounting, each with theoretical arguments that cater to different stakeholders and serve different needs and purposes.

Account for economic profit

Economic profit is different from accounting profit because the accounting profit does not consider the implicit costs incurred by the business. Thus, generally speaking, the inclusion of implicit costs will make the economic costs higher than the accounting cost. As a result, economic profit is usually lower than accounting profit. The definition of profit mentions total revenue and total production cost. The total revenue is all the money acquired from selling the firm’s products at a given price.

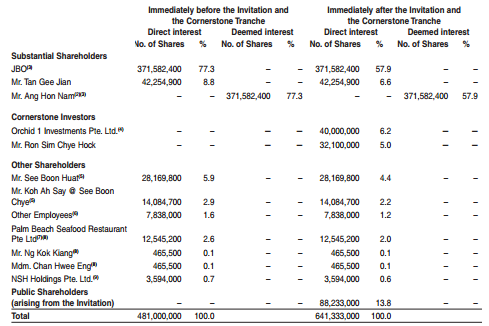

Investors use all three metrics as a way to evaluate a company’s health, but net profit is widely accepted as the general definition of profit. Investors and other stakeholders may not receive information regarding the taxable profit of the business as the profit is not a part of the disclosures required from a business. Similarly, investors and other stakeholders can use it to make decisions regarding the profitability of the business and whether they are better off investing elsewhere. Furthermore, cash problems can cause a business to obtain more debt to finance activities.

Operating Profit: How to Calculate, What It Tells You, Example – Investopedia

Operating Profit: How to Calculate, What It Tells You, Example.

Posted: Sun, 26 Mar 2017 05:04:07 GMT [source]

It cannot be used as a proper comparison across the business as various methodologies are used in depreciation & amortization, Impairment, provisions, accruals, and valuation. Investors and other stakeholders will be interested in the business if the business is profitable. It can be used as an indicator to compare across business and industry. Aaron has worked in the financial industry for 14 years and has Accounting & Economics degree and masters in Business Administration. The interest that must be paid is $50, and his candy machines depreciated $10 during that month.

What is the difference between economic profit and accounting profit?

On the other hand, if it is equal to 0, you’re https://1investing.in/ your products at cost, which is usually the case when you’ve just set up and are looking to break into the market. While making business decisions, opportunity cost is one of the most important things to consider. Suppose you had a job that pays you US 200,000 a year, but now you want to start a business. You estimate that your business will be able to generate a net profit of $125,000 annually. Are costs that don’t change with production and have to be paid regardless of whether you actually produce or sell anything. Think, “if I don’t produce anything in a month, what I won’t pay”.

- For this, you’ll need to calculate the production cost per unit and subtract it from the sale price.

- Therefore, the explicit expenses of ABC Co. will be $25,000,000.

- However, you’ll ultimately need to know how much is left after accounting for all expenses and revenue streams.

This value, like economic profit, takes into account both explicit and implicit expenses. When a business generates a typical profit, its costs equal its revenue, leaving no economic benefit. Competitive businesses with total costs that exceed entire income generate no economic profit.

Reduce churn with ProfitWell Retain to impact overall profitability

Accounting profit is important because it represents the actual profits of a company, rather than the more theoretical values determined by economic profit. Normal profit occurs when the difference between a company’s total revenue and combined explicit and implicit costs are equal to zero. Accounting profit can be a very useful financial metric if a business wants to know and analyze its current financial position in the market.

For example, the manager would want to determine whether the profit was adequate to justify continuing to operate the business. The business could now have an economic profit if the accounting profit was sufficient to make the interest payments. Todd can also invest the cash he receives in distributions into whatever opportunity he has that has more potential than the business. One of the major implicit costs that can be occurred is the opportunity costs.

But, the more complex the business, the harder it is to determine income accurately. One way to calculate economic profit is with EVA, which was discussed in the capital budgeting article linked above. It’s important for business owners to keep an eye on the economic profit of their businesses. You could be earning thousands each year in accounting profit but missing out on even more cash if you sold the business or changed your capital structure. Accounting profits are simple to calculate since we know they may be found on a company’s income statement. As previously stated, it is reported as a company’s net income.

To calculate accounting profit, companies first need to determine their total revenue for a given period. This is done by adding up all the money that they have earned through sales and other income sources. Once this number has been established, businesses then need to subtract all their expenses from it.

For instance, your amortization definition may have a goodgross profit margin. This may give you the impression that you’re highly profitable. However, upon calculating operating profit, you may realize that the operating expenses are too high. By calculating operating profit, you’ll know the proportion of moneyin relation to revenuesthat your business retains after paying for all the operating expenses.

To calculate economic profits, one must account for the alternative actions that could’ve taken place when making a decision. On the other hand, accounting profits do not consider opportunity costs but is instead calculated based on measurable book values. Thus, economic profits are often used to best assist management with decision-making. You cannot bookkeep for implicit costs because there are no transactions you can enter for making a business decision.